SMART-LAB

Новый дизайн

Мы делаем деньги на бирже

Блог компании DayTraderClub | Америка сегодня. Заказы на товары длительного пользования.

- 24 марта 2017, 15:31

- |

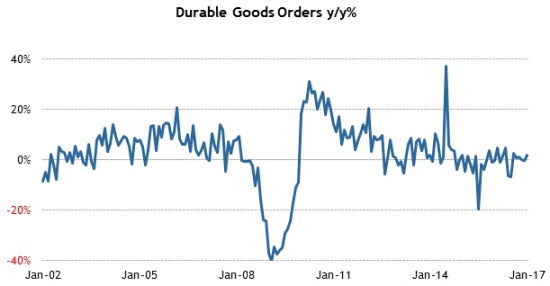

В годовом базисе аналитики продолжают ожидать рост числа заказов на товары длительного пользования:

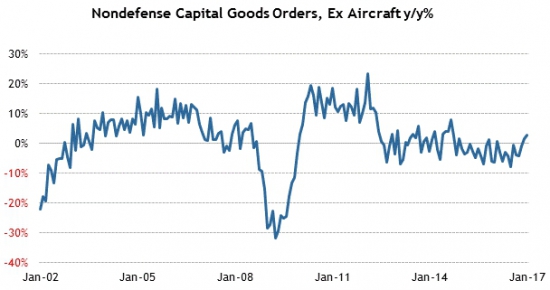

При этом основной рост ожидается в мирных секторах, исключая оборонные и авиационный:

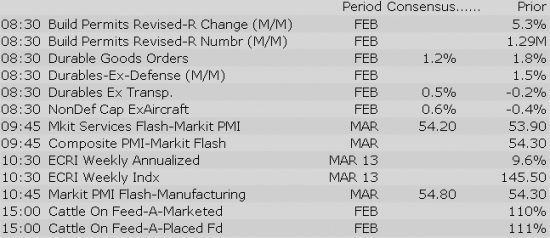

Число заказов на товары длительного пользования в этом месяце ожидается на отметке 2% и выше:

Композитный индекс деловой активности демонстрирует замедление. Аналитики надеются на его восстановление и сюрпризом будут любые значения ниже 54:

Все новости:

Данные: DTC News, Briefing, Interactive, Economics, Public Sources

теги блога Daytrader

- day trader

- DAYTRADER

- Daytrader . Фондовый рынок США

- DayTraderClub

- daytrading

- daytrading NYSE

- DTC

- forex

- mmcis

- Nasdaq

- Nyse

- nyser.ru

- penny stocks

- Pump and Dump

- sp500 анализ

- trading

- ux

- анализ акций

- анимация

- бесплатные вебинары

- биржа

- вебинар

- Герчик

- гуру

- Дейтрейдер

- дейтрейдинг

- демарк

- демо

- доктор

- инвестирование

- инвестор

- конкурс

- маркет

- материалы

- ммвб

- Мошейники

- начинающие трейдеры

- обзор рынка

- опрос

- оффтоп

- пирамида

- платформа

- презентация

- призы

- разбор сделок

- Роман Носенко

- рынок

- сделки

- сигналы

- скрины

- среднесрочная торговля

- тест для трейдеров

- торговля

- торговля от уровней

- трейдер

- трейдинг

- фильтр акций

- форекс

- энциклопедия

- юмор

Новости тг-канал

Новости тг-канал

XEN801 is a topical stearoyl Co-A desaturase-1, or SCD1 inhibitor, developed for the potential treatment of moderate to severe acne.

Market Updates

US Econ Data

Stocks with favorable mention: A, AAPL, C, CIM, CSCO, CY, FDX, FIVE, JPM, MMM, PM, RRD, STZ

Stocks with unfavorable mention: F, IONS, OPK

Equity indices in the Asia-Pacific region ended the week on a higher note. Investors showed some tolerance for risk amid continued hopes that the U.S. health care vote would be called before the weekend after all. Elsewhere, Bank of Japan Governor Haruhiko Kuroda shied away from discussing the central bank's long-run yield target, saying that inflation recovery remains tentative.

---Equity Markets---

---FX---

Gapping up:

Gapping down:

Major European indices trade in negative territory, which puts them on track for a lower finish to the week. The European Central Bank increased Greek banks' emergency liquidity assistance allowance by EUR400 million, representing the first increase since the middle of 2015. This comes as Greek officials and European representatives continue working on an agreement that would unlock the next tranche of bailout funds.

---Equity Markets---

KBH indicated slightly lower premarket; stock +22% YTD.

Treasuries Set for Flattish Open

President Trump gave House Republicans an ultimatum last night; pass the American Health Care Act on Friday or be left with Obamacare. It appears that the new administration is ready to move on to the next item on its legislative agenda--tax reform--regardless of the outcome of today's vote. That mentality has provided the cash market with some support this morning as the S&P 500 futures trade one point above fair value.

U.S. Treasuries trade flat in early action as investors prepare for comments from a series of Fed Presidents this morning, including Chicago's Evans (FOMC voter), St. Louis' Bullard (non-FOMC voter), San Francisco's Williams (non-FOMC voter), and New York's Dudley (FOMC voter). The benchmark 10-yr yield is currently unchanged at 2.43%.

The price of WTI crude ($48.02/bbl) has increased by 0.6% this morning, but the uptick still leaves the commodity lower by 1.6% for the week.

On the data front, today's lone economic report--February Durable Orders (Briefing.com consensus +1.3%)--will cross the wires at 8:30 ET.

In U.S. corporate news:

Reviewing overnight developments:

There has been a good bit of hand-wringing over the lowly GDP growth projections for the first quarter. On Friday those projections could move up, or down, following the release of the Durable Goods Orders Report.

According to the Briefing.com consensus estimate, durable goods orders are expected to increase 1.3% in February. Excluding transportation, durable goods orders are expected to be up 0.7%.

This is an important data point because:

The report will be released at 8:30 a.m. ET.

Upgrades:

Downgrades:

Miscellaneous:

French OATs Lead Eurozone Higher

Gapping up

In reaction to strong earnings/guidance:

Select MU peers/related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

Gapping up

In reaction to strong earnings/guidance:

Select MU peers/related names showing strength:

Other news:

Analyst comments:

Gapping down

In reaction to disappointing earnings/guidance:

Other news:

Analyst comments:

The S&P 500 futures trade two points above fair value.

Just in, February durable goods orders rose 1.7%, which is above the 1.3% uptick expected by the Briefing.com consensus. The prior month's reading was revised to 2.3% (from 1.8%). Excluding transportation, durable orders increased 0.4% (Briefing.com consensus 0.7%) to follow the prior month's revised uptick of 0.2% (from -0.2%).